For investors looking to expand their property portfolio, buying second property in Singapore can be an exciting opportunity. With a strong real estate market and a stable economy, Singapore remains a popular destination for property investment.

However, the process of purchasing a second property involves more than just finding the right home—it requires a solid understanding of the regulations, financial implications, and strategic planning that can help make your investment successful.

This guide will walk you through the essential steps and considerations involved in buying second property in Singapore, providing you with the knowledge to make an informed decision.

1. Understanding the Market and Timing Your Purchase

Before diving into the process of buying a second property, it’s crucial to understand the state of the property market in Singapore. The real estate market is cyclical, and property prices can fluctuate based on a range of factors, including economic conditions, interest rates, and government policies.

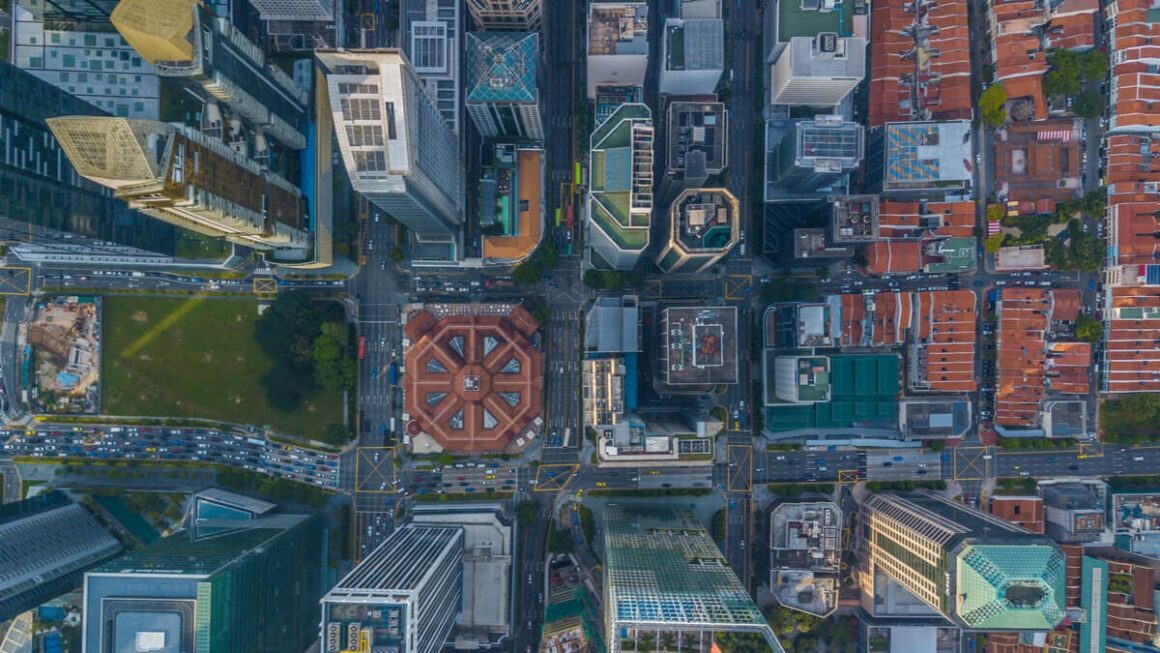

Researching market trends is key when considering the timing of your second property purchase. Over the past decade, Singapore’s property market has shown steady growth, particularly in key districts like the Central Business District (CBD), Orchard Road, and Sentosa. Additionally, there has been increasing interest in suburban areas due to the expansion of transportation networks and amenities in these regions.

As an investor, it is essential to consider whether it is the right time to buy based on market conditions. For example, a period of low interest rates may be ideal for securing a property at a lower cost. Conversely, a high-growth market may provide better potential for capital appreciation. Keep an eye on government measures such as stamp duties, tax incentives, and cooling measures, as these can significantly impact the buying process.

2. Financial Considerations and Eligibility

When it comes to buying second property in Singapore, understanding your financial position and eligibility is a critical step. Singapore has specific rules regarding financing for second properties, especially for individuals who already own one residential property.

Loan-to-Value (LTV) Ratio

The Loan-to-Value (LTV) ratio is a key factor that determines how much you can borrow from the bank to finance your second property. For your second home, you are generally only allowed to borrow up to 45% of the property value if you are not purchasing through a mortgage equity scheme. This is lower than the LTV ratio for a first property, which can be up to 75%.

Additional Buyer’s Stamp Duty (ABSD)

One of the most important aspects of buying second property in Singapore is the Additional Buyer’s Stamp Duty (ABSD). This is an additional tax imposed on property purchases, and the rate increases when you are purchasing a second or subsequent property. For Singaporean citizens, the ABSD for the second property is currently set at 12%, while permanent residents (PRs) pay 15%. Foreigners face a higher ABSD of 20%.

It is important to factor in the ABSD when calculating your total costs of purchasing a second property, as it significantly affects your investment. For instance, a property worth S$1 million would incur an ABSD of S$120,000 for a Singaporean citizen purchasing a second property.

Total Debt Servicing Ratio (TDSR)

The Total Debt Servicing Ratio (TDSR) is another key consideration for investors when buying a second property. This ratio calculates the percentage of your monthly income that goes towards servicing all your debts, including mortgage repayments. The TDSR is capped at 60%, meaning that your total monthly debt obligations cannot exceed 60% of your monthly income.

It’s essential to ensure that your existing financial obligations, such as car loans, credit card debts, and the mortgage for your first property, do not push your TDSR above the cap. If you exceed the limit, you may not be eligible for a loan on your second property.

3. Types of Properties to Consider

Singapore offers a wide range of properties for investors to consider when buying a second property. Understanding the different types of properties can help you make a decision based on your investment goals.

Private Condominiums

Private condominiums are among the most popular choices for investors. They offer a good balance of rental income potential and capital appreciation. Condominiums often come with amenities such as swimming pools, gyms, and security, which can attract tenants looking for a higher standard of living.

Investing in a private condominium in an area with high demand, such as near business hubs or transportation hubs, can provide good returns on both rental income and capital gains.

Landed Properties

Landed properties, such as terraced houses, semi-detached houses, and bungalows, are typically more expensive than condominiums but can provide significant rental returns, especially in well-established areas. However, they come with higher maintenance costs and are subject to stricter rules, including a requirement to be purchased by Singapore citizens only.

If you’re looking for long-term capital growth and can afford the higher upfront costs, landed properties could be a good option for your second investment.

HDB Flats

Although Singapore’s Housing and Development Board (HDB) flats are not available for investment as second properties for non-citizens, Singaporeans who meet the eligibility criteria can purchase an HDB flat for rental purposes. However, it is important to note that HDB flats come with restrictions on resale and renting out the property, making them less flexible for investors.

4. Finding the Right Property Agent

Engaging a reliable property agent who is experienced in the Singapore market is essential when buying a second property. A good property agent will help you navigate the legal and financial aspects of purchasing the property, advise you on suitable properties based on your budget and investment goals, and assist with negotiations.

Property agents typically charge a commission based on the purchase price of the property. It is crucial to choose an agent with a solid understanding of the rules surrounding second property purchases, as well as experience in the area where you intend to invest.

5. Legal and Administrative Requirements

Once you’ve found the right property, there are several legal and administrative steps that must be completed in the process of buying second property in Singapore.

Sales and Purchase Agreement

The sales and purchase agreement (SPA) outlines the terms of the transaction, including the agreed price, payment schedule, and other conditions. The SPA is usually drawn up by a lawyer, and it’s important to carefully review all terms before signing.

Stamp Duty and Registration

In addition to the ABSD, buyers are required to pay stamp duty on the purchase of a second property. The stamp duty rate for property transactions is 1% on the first S$180,000 of the purchase price, and 2% on the remainder. This cost is due upon signing the SPA and must be paid before the property transfer can be finalised.

Transfer of Ownership

The final step involves the transfer of ownership, where you officially become the owner of the property. Once the property is registered under your name, you are free to rent it out, renovate it, or sell it according to your investment strategy.

6. Rental Income and Property Management

If your goal for buying a second property in Singapore is to generate rental income, managing your property effectively is key. Ensure that your property is well-maintained and located in an area with high demand for tenants. Consider whether you want to manage the property yourself or hire a property management company to handle the day-to-day operations, such as finding tenants, maintenance, and rent collection.

Conclusion

Buying second property in Singapore can be a profitable venture if approached with careful planning and knowledge of the regulations and market conditions. From understanding the financial requirements to selecting the right type of property, every step is important in ensuring that your investment yields positive returns. By considering factors such as loan eligibility, ABSD, and market trends, and consulting with a property agent, investors can make informed decisions that align with their financial goals.

With the right strategy in place, buying second property in Singapore could offer both short-term rental income and long-term capital gains, making it a sound investment for the future.