Finding the right rental property can feel competitive, especially in busy markets where landlords review dozens of applications for a single unit. While credit scores and references matter, proof of income is often the deciding factor. Property owners want reassurance that rent will be paid on time and consistently. If you understand what landlords expect and prepare your documents carefully, you can stand out and secure the home you want.

Below is a practical guide to what landlords typically look for in proof of income and how you can strengthen your rental application with confidence.

Why does proof of income matter so much?

From a landlord’s perspective, renting out a property is a financial decision. Monthly rent must cover mortgage payments, maintenance, and other expenses. Reliable tenants reduce risk and prevent costly late payments or evictions.

That is why many landlords follow the standard rule that a tenant’s monthly income should be at least two and a half to three times the rent. For example, if rent is $1,200 per month, they may want to see at least $3,000 to $3,600 in monthly income. Proof of income documents help verify that you meet this threshold.

Common documents landlords accept

Different applicants have different work arrangements, so landlords usually accept several types of income documentation. Providing more than one can strengthen your case.

Here are the most commonly requested items:

Recent pay stubs from the last two or three months

An employment verification letter from your employer

Bank statements showing regular deposits

Tax returns, W-2, or 1099 forms for freelancers

Offer letters for new jobs

Social Security or benefit statements, if applicable

If you are self-employed or working freelance gigs, tax returns and bank records become especially important. Showing consistent deposits over time reassures landlords that your income is stable, even without a traditional paycheck.

Show consistency, not just high numbers

Many renters focus only on how much they earn. Landlords also care about how predictable that income is. A single large deposit will not carry as much weight as steady payments every month.

Organize your paperwork to clearly show a pattern. Highlight regular paydays, repeat clients, or ongoing contracts. If you have variable income, consider providing an average of the last six to twelve months to demonstrate stability.

Consistency tells landlords you are less likely to miss rent during slower months.

Be organized and professional

Presentation can influence a landlord’s impression more than you might think. Submitting blurry screenshots or scattered files can make you appear careless or unprepared.

Instead, combine your documents into one clean PDF or folder. Label each file clearly. Include a short cover note explaining what each document shows, especially if your income situation is complex.

A professional presentation signals that you will treat the rental and the lease with the same level of responsibility.

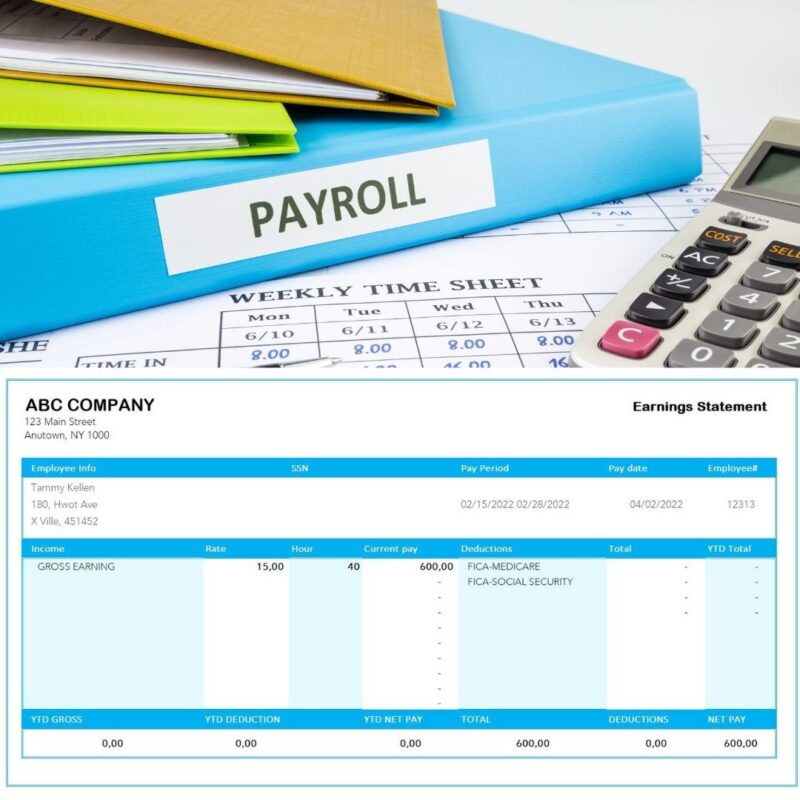

Prepare accurate pay documentation

If your employer does not automatically provide detailed pay stubs or if you work as an independent contractor, you may need to create formal income records yourself. In this case, tools like a paystub generator free option can help you produce clear and organized stubs that reflect your earnings, deductions, and dates. Just make sure all information is truthful and matches your bank deposits and tax records. Accuracy is essential, as landlords may verify the details.

Clean documentation makes it easier for landlords to assess your income quickly, which can speed up the approval process.

Add extra proof if your income is borderline

If your income barely meets the requirement, do not assume your application will be rejected. Instead, strengthen it with additional assurances.

You might consider:

Offering a larger security deposit if allowed

Providing a qualified co-signer

Showing significant savings in your bank account

Including strong references from previous landlords

Paying several months of rent in advance

These steps reduce the landlord’s risk and can compensate for lower or irregular income.

Self-employed renters need extra preparation

Freelancers, consultants, and gig workers often face extra scrutiny because their income can fluctuate. Planning makes a big difference.

Keep detailed records throughout the year. Save invoices, contracts, and receipts. Use accounting software or spreadsheets to track monthly earnings. When applying for a rental, provide at least one year of tax returns along with recent statements.

You can also attach a simple income summary sheet that outlines your average monthly earnings. This helps landlords quickly understand your financial picture without digging through pages of data.

Use templates to stay consistent

If you need to create supporting documents such as income summaries or invoices, using a free paystub template can help maintain a professional and consistent format. Templates ensure you include important details like dates, gross income, and deductions, which makes your paperwork easier to read and verify. Small details like this can subtly improve how trustworthy your application appears.

Communicate openly with the landlord

Finally, do not underestimate the value of communication. If your income situation is unusual, explain it upfront. For example, if you recently changed jobs or started a new contract, provide documentation and context.

Landlords appreciate honesty and clarity. Addressing potential concerns before they ask shows transparency and responsibility.

Final thoughts

Strong proof of income can be the difference between approval and rejection in a competitive rental market. Focus on clear documentation, consistent earnings, and professional presentation. Provide more information than the minimum when possible, and back up your numbers with reliable records.

By preparing early and presenting your finances confidently, you make it easy for landlords to say yes. A little extra effort can turn your rental application into a winning one and help you secure your next home with less stress.